Executive Brief: The CFO Agenda: Transforming the Finance Function

HBR and PwC outline how CFOs can lead disruption—and avoid being disrupted. Download the executive brief based on the HBR webinar featuring Bob Woods and Tabitha DeFrancisco of PwC.

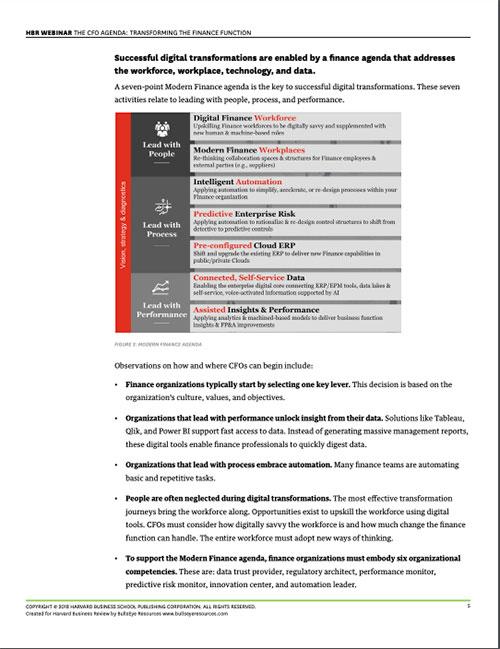

A Seven-Point Modern Finance Agenda

Based on the webinar, The CFO Agenda: Transforming the Finance Function, featuring Bob Woods and Tabitha DeFrancisco of PwC, this executive brief discusses:

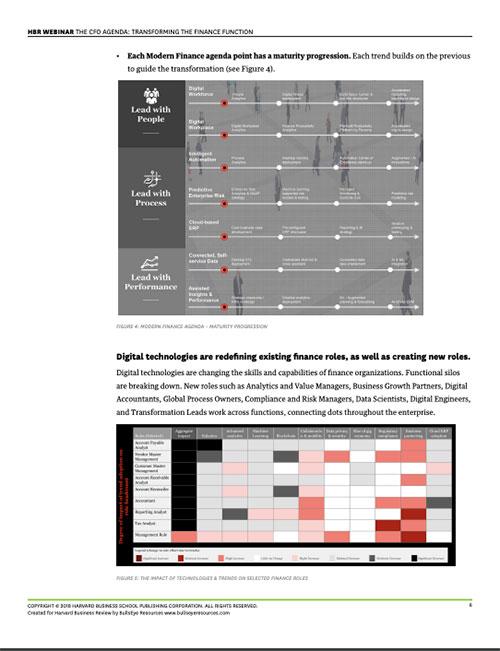

- A seven-point modern finance agenda that supports successful digital transformations

- The competencies needed for new finance roles

- A case study of a corporate Controller enabled by a modern finance workplace

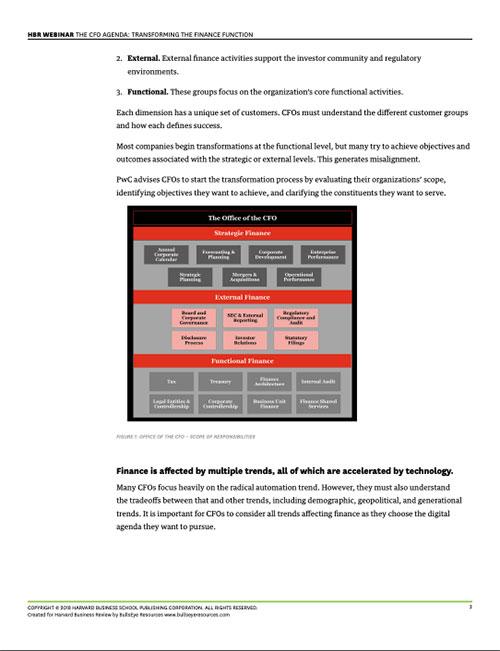

Because Chief Financial Officers have insight into every business unit, they have visibility into opportunities that can be unlocked by information-led transformations. It is therefore no surprise that CFOs are assuming new strategic roles.

Tasked with guiding the growth of companies, building digital organizations, and transforming the finance function, CFOs must first identify their objectives and then decide whether they will lead with people, process, or performance.

FAQ