Making Tax Less Taxing with Vertex & Coupa

Today's post is written by guest author Kristin Schwabenbauer, Global Partner Leader at Vertex. Kristin manages Vertex’s relationships with procurement-focused organizations. With these efforts, she looks to build the most robust integrations that meet our clients’ needs and expectations. Vertex is a certified CoupaLink Technology Partner that enables businesses of all sizes to achieve reduced costs and improved tax accuracy across all purchases and transactions while positioning the business for success.

For more than 40 years, Vertex has been providing tax technology, services, and software to help companies be confident that the tax they pay is the tax they owe. The company provides support for tax and IT departments to manage taxes on invoices and direct and indirect spend across local, state, federal, and global jurisdictions.

In 2015, Coupa began connecting with many of the same clients served by Vertex and reached out with a proposal: to integrate Vertex's in-depth business tax solution with Coupa's Business Spend Management (BSM) platform to help streamline clients' spending and tax operations.

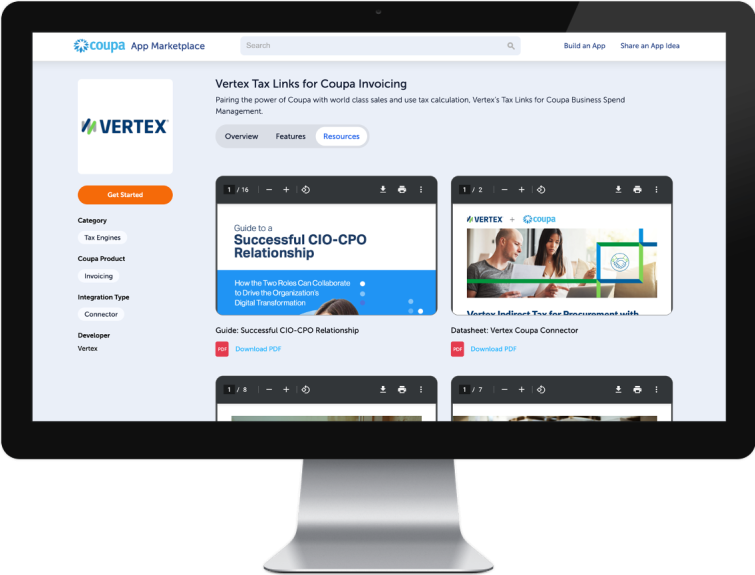

Check Out Vertex in the Coupa App Marketplace

Understanding the tax landscape

As the old saying goes, nothing is certain but death and taxes.

Even that quote, however, isn't entirely accurate. With more than 17,000 tax jurisdictions in the United States alone — including federal, state, county, and municipal jurisdictions — taxes may be inevitable, but they're far from certain. What companies owe in tax depends on a host of factors, including what they buy, where they buy it, and how it is reported. And that's just for the United States. Businesses operating retail or e-commerce stores outside the U.S. are subject to local tax laws wherever they buy or sell goods and services.

Consider a consumer who lives in Delaware but travels across state lines to purchase a television in Pennsylvania. Even though the purchase was made in another state, Pennsylvania still wants to collect tax on that purchase. The same applies to companies — for example, a business that buys laptops in Texas and ships them to their office in Chicago is subject to Illinois tax. And the landscape is getting more complicated: In 2018, the Supreme Court ruled that businesses without a physical presence in the state could be charged state tax after Illinois asserted that e-commerce giant Wayfair should be subject to these taxes since they were effectively doing business in the state.

The result? Taxes are certain but changing — and companies need to keep up.

What does this mean for procurement and finance teams?

Reducing tax-related risk and empowering collaboration

If companies don't pay the right tax, the IRS (or other tax agency) comes knocking — and they want their money. For staff in charge of purchasing and invoicing, however, it's not always clear if the correct amount of taxes has been paid, or even if the company has been charged the right amount. For example, if a vendor doesn't charge a buyer the right amount of tax on a purchase, that doesn't exempt the buyer from the tax due; it simply defers the responsibility of accounting for the tax to the buyer.

And while some taxes are straightforward — for example, sales tax is what's known as a "pass-through" tax and is simple to track and calculate — other taxes, such as consumer use tax, are more complicated. Also called a compensating tax, consumer use tax is complementary to sales tax and is calculated as a percentage of the sales prices of goods and services and paid as a use tax, typically when businesses purchase something from out of state. In many cases, retailers aren't required to collect this consumer use tax, but companies are required to pay it. Without a robust tax solution in place, however, it's easy to miss this requirement.

What’s more worrisome is that if companies are audited by tax agencies and they can't prove that they've paid the tax, and paid enough, they could be fined for the oversight — even if they contest the judgment, the money still has to come off their books.

Fortunately, the Vertex and Coupa collaboration provides a way for companies to create KPIs for their tax collection and record-keeping that helps reduce the risk of accidental non-payment and avoid the costly outcomes of a tax audit.

Educating clients and enhancing tax management

With full support for Coupa integration, Vertex helps businesses streamline tax calculation and payment processes. Relevant taxes are automatically calculated and applied, and problems are automatically flagged.

But it doesn't stop there. While many clients — and Coupa — don't want to become tax experts, Vertex has been in the tax business for more than four decades. Not only does this speak to the company's expertise, but it also paves the way for procurement and accounts payable (AP) staff to learn more about relevant tax processes without getting overwhelmed.

Taking on the future of tax

As companies go digital and shift global, taxes are becoming more complicated. From taxes on digital storefronts that don't have a physical and local presence to increasingly convoluted consumer use tax regulations, it's easy for taxes to slip through the cracks. With Vertex and Coupa, you can align tax payment and line-of-business operations while reducing complexity and preparing your organization to be ready for whatever the future brings.

Check Out Vertex in the Coupa App Marketplace